The President of the United States has declared a national emergency; schools are closed; national sports leagues and concerts and other live entertainment has been canceled; the size of gatherings restricted; bars and restaurants are closed, however some organizations and businesses must continue to operate and teleworking for employees may not be an option. Various labor and employment laws regulate what an employer can do, including, but not limited to, the Americans with Disabilities Act (ADA), Title VII, the Family Medical Leave Act (FMLA) and Fair Labor Standards Act (FLSA), and the state and local law counterparts of these laws. Of principal import to employers is how to address employees that may be displaying symptoms and/or who may have traveled to locations where COVID-19 is more prevalent. The law most likely to be violated in this circumstance is the ADA. The ADA:

- Regulates employer’s disability-related inquiries and medical examinations for all applicants and employees, including those who do not have ADA disabilities;

- Prohibits covered employers from excluding individuals with disabilities from the workplace for health or safety reasons unless they pose a “direct threat” (i.e. significant risk of substantial harm even with reasonable accommodation); and

- Requires employers to provide reasonable accommodations for individuals with disabilities (absent undue hardship) during a pandemic.[1]

In addition to the above requirements, the ADA requires that employers keep information regarding an employee’s disability confidential and not disclose to beyond those with a ‘need to know.’

The ADA protects employees (and applicants) from disability discrimination by covered employers and prohibits employers from engaging in activities that would adversely impact and affect workers with disabilities (or those with perceived disabilities). A “covered employer” is an employer with fifteen or more employees (including full-time and part-time employees). However, the following guidance is of use to employers who have less than 15 employees because these employers are likely governed by state and local laws and ordinances that apply to employers with four or more employees. While COVID-19 is a transitory illness and is not considered a “disability” under the ADA, employers can “regard” employees affected by COVID-19 as being disabled, which could result in a violation of the ADA. This guidance is derived from the United States Equal Employment Opportunity Commission (“EEOC) “Pandemic Preparedness in the Workplace and the Americans with Disabilities Act,”[2] CDC Interim Guidance to Business, and OSHA guidance[3]. It will be updated as more information becomes available or as the situation changes.

With the World Health Organization’s declaration of a COVID-19 Pandemic and the declaration of a national emergency, there will certainly be incidences in the workplace where an employee’s condition or potential condition meets the definition of a “direct threat” under the ADA. The CDC’s guidance indicates that employers may “actively encourage” sick employees to stay home. CDC guidance describes a sick employee as one that has symptoms of acute respiratory illness (cough, shortness of breath, etc.) and fever over 100.4° F or greater (using an oral thermometer). The CDC further recommends that employees who appear to have acute respiratory illness symptoms upon arrival to work or become sick during the day should be separated from other employees and sent home immediately. The following guidance relates strictly to COVID-19 under the current conditions and does not apply to normal operating conditions.

Q1: May an employer send employees home if they display COVID-19 symptoms?

Yes. The CDC states that employees who become ill with symptoms of COVID-19 at work should leave the workplace. Advising such workers to go home is not a disability-related action if the illness is related to COVID-19.

Q2: How much information may an employer request from employees who report feeling ill at work or who call in sick?

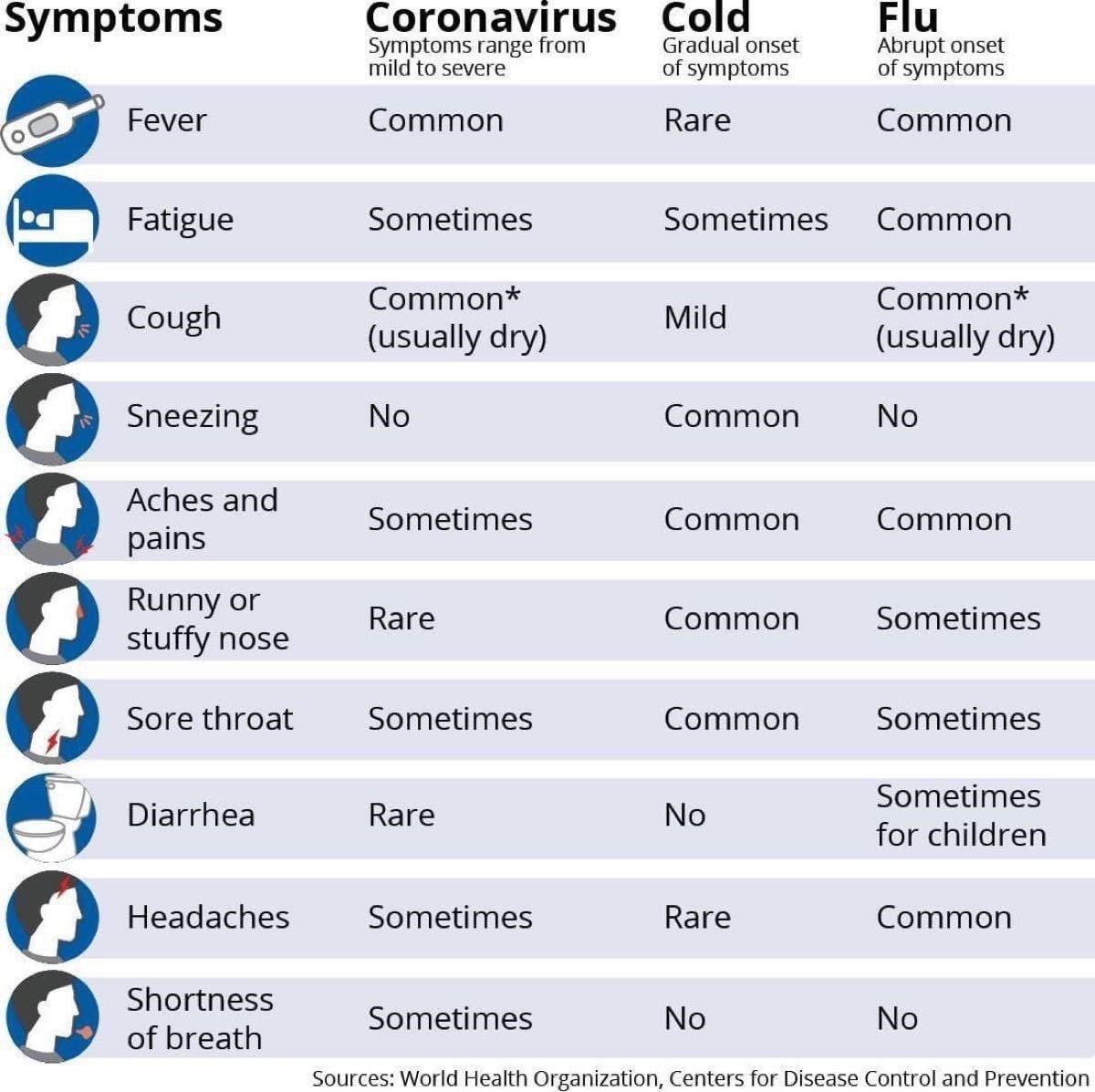

Employers may ask employees if they are experiencing COVID-19 symptoms, such as fever and shortness of breath. Employers must maintain all information about employee illness as a confidential medical record in compliance with the ADA. See chart at the end of this Guidance regarding symptoms of COVID-19, cold and regular flu. Keep in mind, it is allergy season.

Q3: May an employer require an employee to notify it if the employee has been exposed to, has symptoms of, or has tested positive for COVID-19?

Yes. An employer can require an employee to notify his/her supervisor or HR that they have COVID-19 symptoms or have been exposed to someone with COVID-19. For example, if the employee’s child has returned from Italy and has been notified that she is positive for COVID-19, the employee can be required to notify the employer that they have been exposed to someone who has COVID-19.

Q4: What should an employer do if an employee has tested positive for COVID-19 or is suspected to have COVID-19?

Send the employee home for at least 14 days (but before the employee leaves, make sure the employee informs HR or a supervisor of all employees that have been within 3 to 6 feet or closer to the employee during the previous 14 days.) In addition, all employees who worked closely with that employee should be sent home for at least 14 days. DO NOT identify the infected employee (see above guidance on confidentiality). Retain a cleaning company to deep clean the affected workplace and inform the landlord or others as appropriate (elevator cleaning, etc.).

Generally, an employer may send a non-exempt (hourly employee) home from work without pay.[4] Workers paid on a salary-basis (exempt employees) must be compensated for the full day if the employee performed compensable work (at the office or at home). In the event of a work closure or furlough, provided that employees are not performing any work (not answering or checking emails, etc.), exempt employees may not have to be compensated. If the employer is closing the office for less than a full workweek, the employer must pay the exempt-employee’s full salary even if: 1) the employer does not have a bona fide benefits plan; (2) the employee has no accrued benefits in the leave bank; (3) the employee has limited accrued leave benefits and reducing that accrued leave will result in a negative balance; or (4) the employee already has a negative balance in the accrued leave balance. Employers can require its exempt staff to use vacation or PTO for workplace closures.

Q5: May employer take its employees’ temperatures to determine whether they have a fever?

Maybe. Generally, measuring an employee’s body temperature is a medical examination. If COVID-19 is determined to be widespread in employer’s community, as assessed by state or local health authorities or the CDC, then employers may measure employees’ body temperature. However, being free of a temperature does not necessarily mean the employee is free of COVID-19.

Q6: When an employee returns from travel during the COVID-19 outbreak, must an employer wait until the employee develops COVID-19 symptoms to ask questions about exposure to COVID-19 during the trip?

No. These would not be disability-related inquiries. The CDC and state and local public health officials are recommending that people who have visited specified locations remain at home for at least 14 days until it is clear they do not have COVID-19 symptoms. Therefore, an employer may ask whether employees are returning from these locations, even if the travel was personal.

Q7: May employer ask employees who do not have COVID-19 symptoms to disclose whether they have a medical condition that the CDC says could make them especially vulnerable to COVID-19 complications?

No. Employers cannot make disability-related inquiries or require medical examinations of employees without symptoms. This is prohibited by the ADA. If an employee voluntarily discloses his/her risk, then the employer should engage in a reasonable accommodation discussion to determine what assistance would be helpful to the employee (telework, isolated work location, etc.).

For example, an employee, who was on disability leave for cancer treatment, is supposed to report back to work, but calls to express discomfort over returning to work. The employer should engage in a reasonable accommodation discussion to determine what accommodation(s) would be appropriate (additional time off from work, telework, different work location, etc.).

Q8: What if an employee refuses to work based upon his/her own fear?

An employer may impose discipline upon an employee who refuses to come into work or perform certain tasks, unless coming into work or the task the employee is required to perform poses “imminent danger” to the employee. Imminent danger under Occupational Safety and Health Act (OSHA) is defined as:

“[A]ny conditions or practices in any place of employment which are such that a danger exists which can reasonably be expected to cause death or serious physical harm immediately or before the imminence of such danger can be eliminated through the enforcement procedures otherwise provided by this Act.”

Imminent danger exists where there is “threat of death or serious physical harm,” or “a reasonable expectation that toxic substances or other health hazards are present, and exposure to them will shorten life or cause substantial reduction in physical or mental efficiency.”

Neither OSHA nor CDC have issued any guidance that COVID-19 would implicate ‘immediate threat of death’ or serious physical harm’ in most workplace situations. An employee with a diagnosis of Germaphobia with a doctor’s note could request a workplace modification and the employer would have to engage in a reasonable accommodation dialogue.

For example, if an employee is required to travel for work by plane to various locations in the United States but is afraid to do so, under current flight restrictions, the employer could compel an employee to travel to work locations throughout the United States. Before doing so, however, the employer should engage in a reasonable accommodation dialogue to determine if the employee has an underlying medical condition that makes it dangerous for the employee to fly. If the employee wanted to drive instead, the employer could permit this, but the employer must comply with the Portal-to-Portal Act with respect to paying the employee for his time spent driving instead of flying to the location. Employers should consult CDC guidance on Avoiding Nonessential Travel and State Department and DHS Travel Advisories.

Q9: Can an employer prohibit an employee from personal travel to a restricted area on the employee’s personal time?

Probably not. It depends upon the circumstances. Where travel has been prohibited by governments, then the employer can refuse to grant vacation/paid-time off. The employee can then choose to forgo the travel or risk termination of unemployment. Since the employee’s travel may result in an unreasonable risk to the rest of its workforce, the employer can refuse to approve time off to travel to the high risk area. For locations where travel is permitted but is high to medium risk, the employer could require the employee to stay at home for 14 days after his return.

Q10: May an employer encourage employees to telework (i.e., work from an alternative location such as home) as an infection-control strategy during COVID-19 pandemic?

Yes. Telework has been encouraged by CDC and state and local governments. Telework is a tested and acceptable reasonable accommodation strategy under the ADA. For example, if an employee with a disability that puts him/her at high risk for complications requests telework, this is a reasonable accommodation since it will reduce their chances of a COVID-19 infection.

Q11: May an employer require its employees to adopt infection-control practices, such as regular hand washing and disinfecting work surfaces at the workplace?

Yes. Requiring infection control practices, such as regular hand washing, coughing and sneezing etiquette, proper tissue usage and disposal, and disinfecting work surfaces, does not involve the ADA.

OSHA has issued guidance for all U.S. workers and employers to: frequently wash hands with soap and water for 20 seconds and when soap and water are unavailable use an alcohol based rub (at least 60% alcohol); avoid touching eyes, nose and mouth with unwashed hands and avoid contact with people who are sick. OSHA has issued specific guidance on COVID-19 for workplaces. Please go to: https://www.osha.gov/Publications/OSHA3990.pdf

Q12: May an employer require its employees to wear personal protective equipment (“PPE”) (e.g., face masks, gloves, or gowns) designed to reduce the transmission of pandemic infection?

Yes, but only if the employer is in the healthcare, dental care, laboratory, airline, border protection, or solid waste and wastewater management operations. See OSHA guidance regarding High, Medium and Low Risk work environments. Currently OSHA is not requiring PPE for medium and low risk work environments.

Q13: Can an employer tell an employee not to wear a mask?

Yes. Under most circumstances, if the employer’s workplace is a low or medium risk environment, an employer can tell an employee not to wear a face mask. PPE is required only when necessary to protect the health of the employee. Employers should exercise good judgment when telling an employee not to wear a mask; the mask may make the employee feel more comfortable and less anxious. It could be a reasonable accommodation for an employee that is a Germaphobe (with a Doctor’s note) or is suffering from an anxiety disorder. If the face mask creates a danger, then the employer should prohibit it.

Q14: Once available, may an employer covered by the ADA and Title VII of the Civil Rights Act of 1964 compel all of its employees to take a COVID-19 vaccine regardless of their medical conditions or their religious beliefs?

No. Per the EEOC Guidance:

An employee may be entitled to an exemption from a mandatory vaccination requirement based on an ADA disability that prevents him from taking the influenza vaccine. This would be a reasonable accommodation barring undue hardship (significant difficulty or expense). Similarly, under Title VII of the Civil Rights Act of 1964, once an employer receives notice that an employee’s sincerely held religious belief, practice, or observance prevents him from taking the influenza vaccine, the employer must provide a reasonable accommodation unless it would pose an undue hardship as defined by Title VII (“more than de minimis cost” to the operation of the employer’s business, which is a lower standard than under the ADA).

Q15: During the COVID-19 pandemic, may an employer ask an employee why he or she has been absent from work if the employer suspects it is for a medical reason?

Yes. Justifying or explaining an absence is not a disability-related inquiry. An employer is always entitled to know why an employee has not reported for work. Employers should observe and follow their practices and procedures for absences.

EEOC Example: During an influenza pandemic, an employer directs a supervisor to contact an employee who has not reported to work for five business days without explanation. The supervisor asks this employee why he is absent and when he will return to work. The supervisor’s inquiry is not a disability-related inquiry under the ADA.

Q16: May an employer require a doctor’s note certifying fitness to return to work?

Yes. Per the EEOC guidance, an employer can require a fitness to return to work, which could include a statement from a doctor or other health professional that the employee can return to work and is free from COVID-19. However, the CDC Interim Guidance to Businesses has stated that employers should not request a negative COVID-19 test (which is different than a Doctor’s note that employee does not have symptoms, which an employer can require). The reality is that the employee may not be able to obtain a test. Guidance may change on this and this memorandum will be updated to reflect these changes.

Q17: Is a worker’s COVID-19 contraction a recordable illness that must be recorded on OSHA Logs?

No, unless the employee contracted COVID-19 while on the job. However, the case must be actually confirmed, must be work-related, and must require medical treatment and days away from work (29 CFR 1§ 904.7).

Other Guidance

Employers should be cognizant of the potential of unlawful harassment or a hostile work environment based upon national origin due to COVID-19. Employers should remind employees of the unlawful harassment policies and encourage employees to bring concerns to Human Resources. For example, an employer should not tell employees of Asian descent not to come into the office.

Employers must be cognizant of applicable wage and hour laws and should inform employees of available resources in the event of a furlough, reduction in work hours, or business closure. In jurisdictions where there is paid sick and safe leave, employees will be able to use sick leave to take care of family members who are sick with COVID-19.

An employee could possibly be entitled to Family Medical Leave Act if they meet eligibility requirements. FMLA could not be used while an employee is self-quarantining, but if the employee became sick with COVID-19 or a family member became sick, FMLA leave may be implicated.

Employees who suffer a reduction in work hours or who are furloughed are likely entitled to unemployment compensation benefits. Employers should notify employees of the right to receive unemployment compensation benefits in these circumstances.

Families First Coronavirus Response Act. As of the date of this guidance, the Senate has not acted on H.R. 6201, Families First Coronavirus Response Act. Relevant portions of the bill are:

- Emergency Paid Leave Benefits Section 601– Under Social Security Act. Provides for benefits for emergency leave days for workers: (1) with current diagnosis of COVID-19; (2) who are quarantined (self and imposed); (3) who are caring for another person with COVID-19 or who are under quarantine related to another person who is quarantined; and (4) caring for a child or individual who is unable to care for themselves due to school or childcare program closing. The person must have been working for 30 days before impacted by COVID-19.

- Emergency Paid Leave Benefits Section 602 - This section creates a new federal emergency paid leave benefit program. Eligible workers will receive a benefit for a month (up to three months) in which they must take 14 or more days of leave from their work due to the qualifying COVID-19-related reasons. Days when an individual receives pay from their employer (regular wages, sick pay, or other paid time off) or unemployment compensation do not count as leave days for purposes of this benefit. The benefit amount is 2/3rd of individual’s average monthly earnings up to a cap of $4,000.00. The leave period is one year from January 19, 2020 through January 18, 2021 and benefits are retroactive.

- The Social Security Administration will administer the program. Applications will be taken online and benefits can be paid retroactively. Application deadline is 6 months after enactment. Benefits will be reduced by private or state benefits received.

- Emergency Unemployment Insurance Stabilization and Access Act of 2020. This Act authorizes additional funding to states for additional unemployment benefits if the state (1) requires employers to notify employees of the availability of the benefits; (2) requires employers to offer employees at least 2 ways to apply for benefits; and (3) has a system of notifying employees as to when their claims are/will be processed. This Act provides increased funding to states that have experienced an increase in 10 percent or more of their unemployment rate and provides funding to extend unemployment insurance benefits after the regular 26 weeks of unemployment insurance benefits are exhausted.

- Paid Sick Days for Public Health Emergencies and Personal and Family Care Act.

- Requires all employers to allow employees to gradually accrue 7 days of paid sick leave and to provide an additional 14 days available immediately in the event of any public health emergency, including the current coronavirus crisis;

- Ensures paid sick leave covers days when an employee’s child’s school is closed due to a public health emergency, when an employer is closed due to public health emergency, or if an employee or an employee’s family member is quarantined or isolated due to a public health emergency;

- Reimburses small businesses—defined as businesses with 50 or fewer employees—for the costs of providing the 14 days of additional paid sick leave used by employees during a public health emergency;

- Enables construction employees to receive sick pay based on hours they work for multiple contractors; and

- Makes the bill effective immediately so that employees in areas covered under a qualifying Public Health Emergency, upon the date of enactment, can take 14 days of paid sick leave in order to address COVID-19.

[1] Id, Section II.

[2] https://www.eeoc.gov/facts/pandemic_flu.html

[3] https://www.osha.gov/Publications/influenza_pandemic.html

[4] District of Columbia requires employers to pay “show-up pay” of 4 hours when an employee shows up for work in compliance with their regular work schedule.